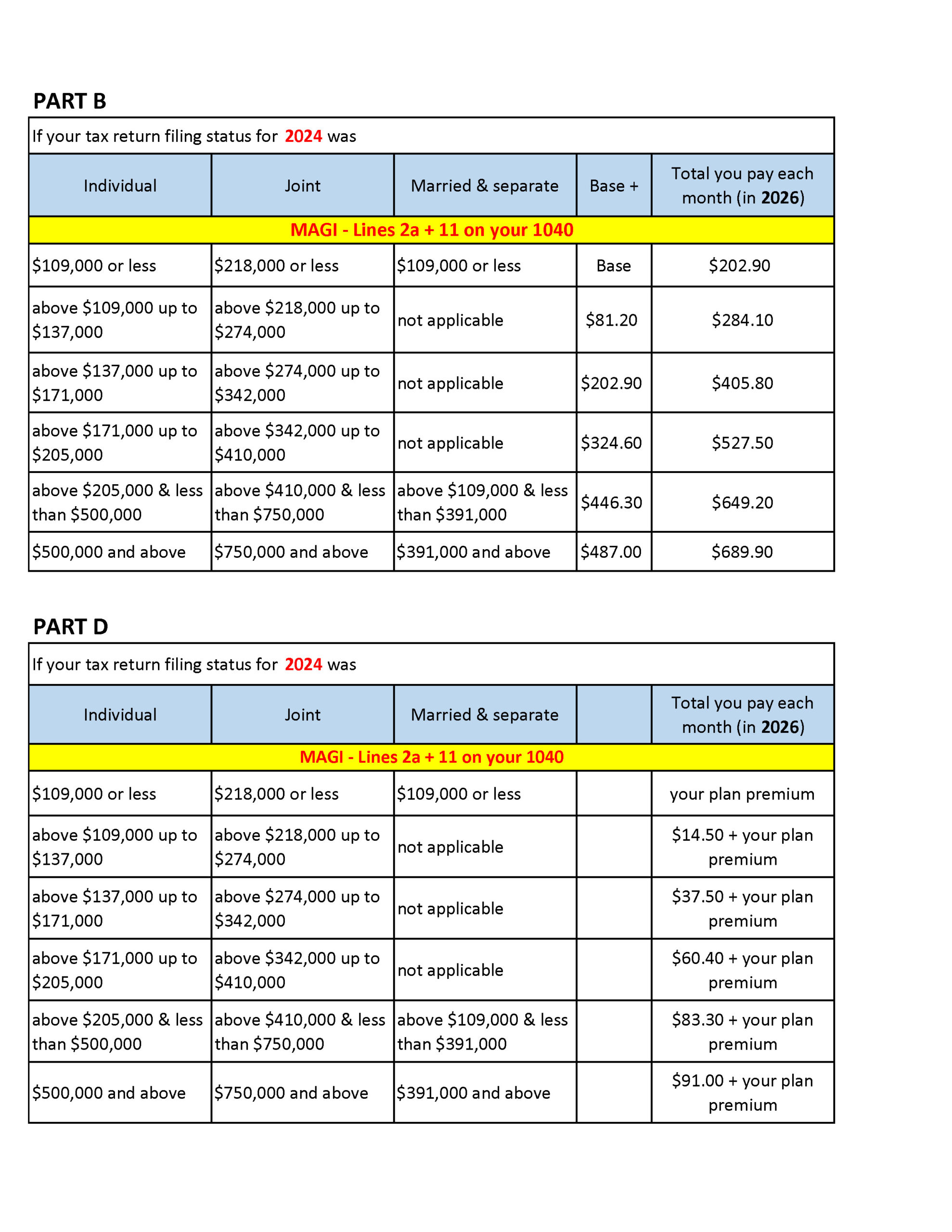

2026 IRMAA Tables

FAQ

Our Most Frequently Asked Questions

Do you want to meet face to face? We will!

Do you know where to start? We will get you started!

Have TV commercials confused you? We will give you the straight scoop!

No, but…

If you are on an employer health plan, you can stay on that plan until you or your spouse retire. That is the most common scenario. The “but” has to do with the size of the employer group, HSAs, COBRA, your health, and the total out of pocket costs on your employer plan - premium plus out of pocket, particularly if you’re on a high deductible health plan.

No, but…

COBRA is not viewed by Medicare as an employer health plan. This means if you opt for COBRA at age 67, you will have to pay a penalty when you enter Medicare. That’s a 10% penalty for life!

Your spouse and dependents can opt into COBRA through your former employer while you go onto Medicare.

No, but…

What we think of as open enrollment is actually called the Annual Enrollment Period in the Medicare world. It runs from October 15 to December 7 for changes being effective January 1st of the next year. You can easily move from one Medicare Advantage plan to another Medicare Advantage plan during that time.

The “but” is moving from Medicare Advantage to a supplement. To make that change, you may have to go through medical underwriting and it is not a slam dunk.

No, but…

There is a penalty if you don’t enroll in a Rx plan (Part D) when you are first eligible. It’s only 1%, but it is life long.

Two other elements compel me to recommend that people get a Rx plan, even if they are not on any chronic medications. #1 – If you are injured or have an infection, you’re going to need medications and you’ll want to have a Rx plan. #2 – If you are diagnosed with a serious illness early in the year, the rest of the year will be an expensive one for you without a Rx plan.

Those national toll free phone numbers are trying to get you to move from one Medicare Advantage plan to another Medicare Advantage plan. The people you are speaking to on the phone have little if any knowledge of the Colorado healthcare landscape, particularly networks.

“You may be eligible for Part B reduction up to $170”. Yes, but…

Very few Medicare Advantage plans offer this reimbursement. Your healthcare providers may not be in network with these plans. In addition, the copays and maximum out of pocket of these plans may be double the amounts you are paying on your current plan.

If you call in, you are opening the door to unlimited call backs from the advertiser

All this to say, working with a local, independent agent is always a better tact.

Yes, but…

I recommend that people sign up for Medicare Part A when they turn 65. Couple of reasons for this. The Part A premium for most people is $0. It does give you additional coverage for a hospitalization. In addition, you receive your Medicare number. This can be important if you need to move quickly onto Medicare due to a change in your employment.

I do not recommend signing up for Part B if you are still on your employer plan.

The “but” revolves around Health Saving Accounts (HSA). If an HSA is a significant part of your retirement strategy, you do not want to enroll in Medicare. Anyone on any part of Medicare cannot continue to contribute to a HSA.

No, but…

Medicare is all about enrollment periods. You can only enroll in various aspects of Medicare if you are in a valid enrollment period. There are a couple of dozen Special Enrollment Periods that may allow you to sign up for a Rx plan outside of the Annual Enrollment Period that runs 10/15-12/7.

But…

Medicare is laden with exceptions as evidenced by all the caveats in questions above. We at Medicare Insurance Help are licensed, independent insurance agents. All we do is Medicare. We know the “buts” and can help you avoid the “gottchas” of Medicare.